Disclaimer: I am working with a couple of startups, some of which have had or are planning to run kickstarter campaigns to fund their projects. I am planning to launch a campaign of my own within the year. And I am deeply concerned about the way Kickstarter is setting up their launch in Germany, a country with very strict and complicated tax laws. Even moreso after hearing Kickstarter’s response when I raised this issue.

Disclaimer: I am working with a couple of startups, some of which have had or are planning to run kickstarter campaigns to fund their projects. I am planning to launch a campaign of my own within the year. And I am deeply concerned about the way Kickstarter is setting up their launch in Germany, a country with very strict and complicated tax laws. Even moreso after hearing Kickstarter’s response when I raised this issue.

Kickstarter, uncrowned king of the crowdfunding scene, has helped entrepreneurs (they call them “creators”) the world over raise more than a combined $1.5 bn (that’s BILLION) to fund their various projects from smartwatches through concerts to potato salads (I’m not kidding) since its launch in 2009. Projects set a goal that they need to reach in order to fund their idea and ask people to contribute sums from a single dollar up to thousands of dollars. Once the campaign has run its course successfully, kickstarter and amazon each take a cut before passing the remaining funds on to the creator, who is then obligated to put them to good use and to honour any promises made in the course of the campaign. The result is in most cases an amazing product that improves the lives of the people using it, although cases are popping up where the funds have been used less than ideally, sometimes through incompetence, seldomly malice. Again, disclaimer: I am working with creators to help set up their campaigns for success and make good on their promises. Therefore I have a vested interest in Kickstarter launching successfully.

Up until May 12 2015 creators in my native Germany had to seek support from somebody in the US when they wanted to start a campaign, which needless to say was a complication few cared for. Kickstarter reacted and as of this May, German citizens will be able to set up campaigns directly through the platform. But while the general course of the campaign will remain the same, the business laws and taxes in Germany are a wildly different beast from the USA. And just like Fiverr two years ago crashed and burned because they neglected to educate users in Germany about the potential pitfalls, so does Kickstarter try to cover its bases with a statement along the lines of “ask your tax attorney” and some advice translated directly from the source page which is plain wrong in parts and could lead to disastrous consequences for entrepreneurs.

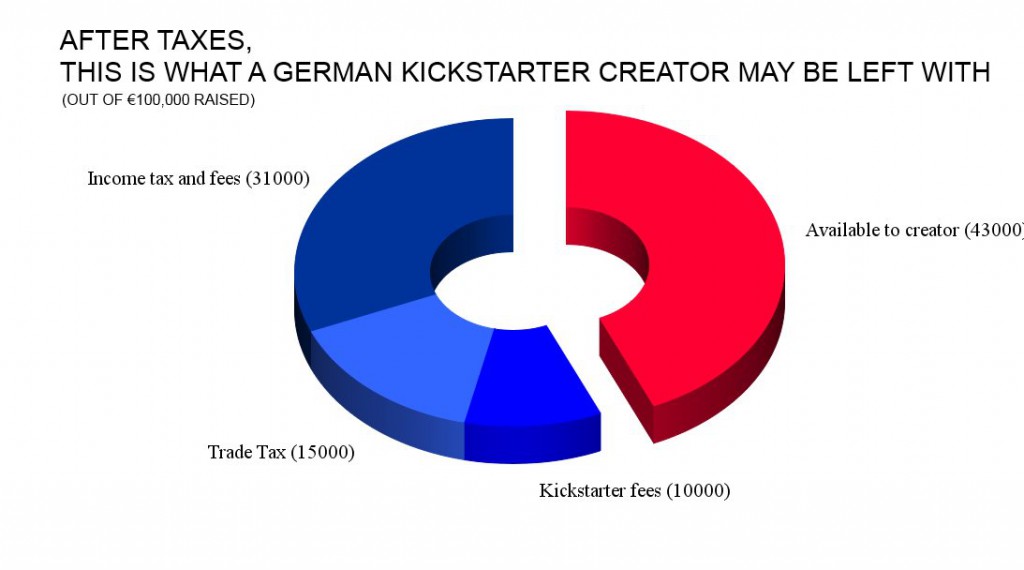

I asked local tax attorney Thomas Kuth for his opinion. He cautioned that receiving funds through kickstarter is taxable income and considered a business activity and as such requires registering a business with authorities. Failure to do so carries a fine. No mention of this on the kickstarter page. Worse, “starting from around 25k raised, trade tax will be charged, which on average will amount to around 17% of the sum taxed.” On top of that, unless funds are immediately passed on before the end of a year, they become taxable income. Depending on factors such as a day job, “another 42% in taxes can be charged”, leaving creators with just over 40% of the sum they originally asked for on kickstarter.

This is compounded by wrong advice concerning income: “Erhält ein Projektgründer beispielsweise Finanzierungsmittel in Höhe von 1.000 $ und wendet im selben Steuerjahr 1.000 $ für sein Projekt auf, können die Ausgaben vollständig vom Kickstarter-Einkommen abgesetzt werden.” This quote from the advice kickstarter has assembled (albeit with the caveat already mentioned) suggests that as long as every Dollar from the fund is spent before the end of the year, the entire sum is fully deductible. This is plain wrong, since the German tax system demands that equipment used to create products (think machinery, but also computers, cameras etc.) above €400 has to be depreciated over several years, depending on the price. A dangerous trap that may leave first-time backers in Germany watching their funds unexpectedly drain while still being obligated to fulfill their promises. Kuth urges:

“Before embarking on any such campaign, a precise calculation is strongly recommended.”

When I reached out to Liz Cook, Film Lead for Kickstarter, while she was touring Germany to warm up creators to the launch, she assured me that kickstarter “are also well aware of the tax implications that German creators will face when fulfilling their projects.” and that they had “put together some useful information to help advise folks” but still confirming that people should “pay careful attention to […] their liabilities” and talk to their tax advisors. She closed with

“There’s no uncertainty there but I appreciate the concern.”

Instead of alleviating said concern, I felt Kickstarter did not take the implications seriously, as no attempt was made to take me up on an offer to help create advice that would actually protect entrepreneurs from said liabilities and give pointers on how to maximise their return on invest – or at the very least Skype about it. Worse, after I took another stab at laying out an example case that would see a German creator be left with a measly €40,500 out of €100,000 raised (and of course, still €100,000 in liabilities) and pointing out serious flaws in the “useful information” I got this back (printed here in it’s entirety, emphasis mine):

“No problem! Thanks for the clarity there. We are currently not looking for someone to fill that role but do appreciate the interest. All employment opportunities – full time or otherwise – are listed and updated regularly on our jobs page. Good luck with your work and thanks again for reaching out. Best, Liz”.

Talk about shot down.

One could argue that it is in fact in the responsibility of every individual starting a campaign to inform themselves and that Kickstarter should remain impartial. But given that the only current requirements to launch a campaign (the promises made within can be considered legally binding) are being 18 and up and owning an ID and a credit card – no hurdle for the average college kid – and seeing how campaigners I have advised were unaware of things as basic as the requirement to meet the goal or get no funds at all, I would not be surprised if a lot of younger people tried funding their dreams through the platform. And land themselves in fiscal as well as legal trouble when the project ends up falling through. With a couple of public cases, the reputation of crowdfunding in Germany could be irreparably tarnished.

I strongly believe crowdfunding brings back passion to the world of capital funding, and that Kickstarter is capable of finally making the concept a driving force in the German economy. Unfortunately, the way they are set up right now with a very hands-off approach to the legal pitfalls that their users can and will face is sure to lead to a couple of very rude awakenings to entrepreneurs. Kickstarter has a chance to shine where Fiverr failed miserably. But ignoring the financial stability and possibly livelihood of their creators as a key factor to their success is irresponsible at best. Raising 100,000 dollars to pay for a production run in Germany, only to be left 60k in debt – a dangerous pitfall indeed.

Ich finde den Artikel irreführend. Das hört sich so an, als wenn das Projekt bis zu 60% des Geldes gar nicht erst bekommen würde.

Sind die Projekte eher dienstleistungsgetrieben (z.B. Programmierung) stellt das Kickstarter-Geld den Lohn bzw. das Einkommen dar, was als solches natürlich zu versteuern ist. Und sinnvoller weise zahlt man von seinem Einkommen auch Alters- und Gesundheitsvorsorge. So gesehen bleibt auch vom Bruttogehalt ganz schön wenig über. Das dürfte aber in den meisten Ländern so sein.

Besteht der größte Teil des Projektes aus Fremdkosten sind diese m.E. auch als Betriebsausgaben geltend zu machen. Und wenn die Kosten erst im nächsten Jahr entstehen, gibt es sowas wie Investitionsabzüge um die Steuerlast im laufenden Jahr zu mindern.

Vereinfachtes Beispiel: wenn du 100.000 € über Kickstarter einsammelst und 70.000 € Fremdkosten hast, dann sind auf die verbliebenen 30.000 € noch Einkommensteur fällig, so dass am Ende auch noch ein Verdienst über bleibt.

Wo ich dir voll zustimme ist, dass finanzielle Planung vorab unablässlich ist.

Danke für Deinen Kommentar. Das Beispiel richtet sich natürlich am Worst Case aus; über das Bilden von Rücklagen und Verlustvorträgen sowie geschickte Planung lässt sich ein Teil der Verluste abfangen. In den USA, wo Kickstarter nun mal herkommen, sieht das aber sehr viel anders aus, was sowohl Steuern als auch Meldepflichten angeht. Und hierrin liegt meine Kritik: Wenn ich als Deutscher unbedarft mal einfach eine Kampagne einstelle ohne mein Gewerbe anzumelden und mit den Abzügen zu kalkulieren kann ich mit Pech auf einem Sack voll Verbindlichkeiten sitzen bleiben. Die Informationen die die Platform zusammengetragen bzw. übersetzt haben ohne sie zu prüfen tun ihr Übriges. Das kann Kickstarter nicht wollen.

Berthold, thank you for interesting information, but I think there is one mistake. Of course not yours mistake, but mistake of Liz, who answered you.

It’s defenetly clear that she looked at your letter as job application (maybe just wrong person to answer you).

So I think you should do it again (better in written form) to get right answer to your question.

Hope it will be possible!